The DeFi sector hasn't exactly been setting the world on fire lately. Post the October 10th crypto crash, the sector is showing some softness, according to a recent FalconX report. Let's dig into the numbers and see if the narrative of "safer" tokens holds water, or if it's just wishful thinking in a down market.

DeFi's Bleeding: Flight to Safety or Just Less Pain?

Decoding the DeFi Downturn

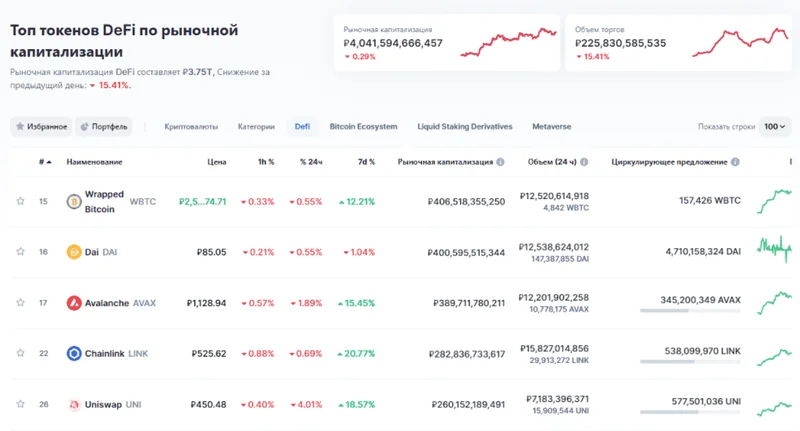

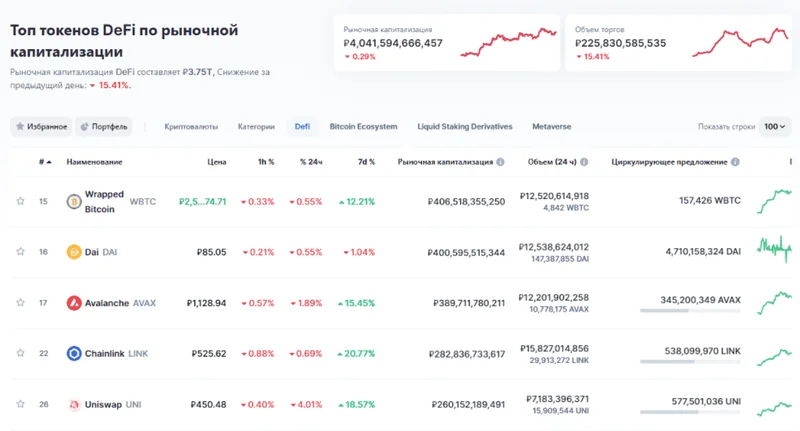

The headline is stark: As of November 20, 2025, a measly 2 out of 23 leading DeFi tokens are in the green year-to-date. The whole group is down an average of 37% quarter-to-date. Ouch. That's not a sector enjoying a bull run; that's a sector licking its wounds. Now, the report suggests investors are flocking to "safer" names – tokens with buybacks or fundamental catalysts. HYPE and CAKE, for example, showed some of the best returns among larger market cap names. Is this a genuine flight to quality, or just a temporary blip?

MORPHO and SYRUP also outperformed their lending peers, apparently due to idiosyncratic catalysts – minimal impact from the Stream finance collapse and growth elsewhere, respectively. It's tempting to see this as smart money moving into resilient assets, but let's be real: outperforming your peers in a *losing* sector isn't exactly a victory parade.

Certain DeFi subsectors have also seen their valuations shift. Spot and perpetual decentralized exchanges (DEXes) have seen declining price-to-sales multiples. Some DEXes, including CRV, RUNE, and CAKE, actually posted *greater* 30-day fees as of November 20 compared to September 30. The report suggests that perp DEXes with HYPE and DYDX multiples are compressing faster than declines in their fee generation.

Lending and yield names, on the other hand, have broadly steepened on a multiples basis. KMNO's market cap, for instance, fell 13%, while fees declined 34%. The theory is that investors are crowding into lending names, viewing them as "stickier" than trading activity. Lending activity might even *increase* as investors bail to stablecoins and hunt for yield.

But here's where I start to get skeptical. Are investors genuinely assessing risk, or are they just chasing the least-bad option in a bad situation?

DeFi "Safety": Rearranging Deck Chairs on the Titanic?

The "Safer" Narrative: A Closer Look

The report paints a picture of investors strategically allocating capital. But is it really strategy, or just a desperate search for *something* that isn't bleeding quite as badly? The "safer" tokens might be benefiting from buybacks, but those buybacks are often funded by… well, *selling* something else. It's a zero-sum game at best, a Ponzi scheme at worst.

And those "fundamental catalysts"? Minimal impact from a competitor's collapse hardly screams long-term value. It's more like being the last house standing after a hurricane. The report also notes that performance QTD suggests investors expect perps to continue to lead. HYPE's relative outperformance, the report suggests, may point to investor optimism around its ‘perps on anything’ HIP-3 markets, which are seeing their highest volumes as of Nov 20. On the other hand, the only crypto trading category seeing record volumes lately are prediction markets. Therefore, the cheapening in the DEX sector may be warranted on lower growth expectations.

I've looked at hundreds of these reports, and this is the part I find genuinely puzzling. Are we really basing investment decisions on *relative* outperformance within a deeply underperforming sector? That's like picking the least-rusty car in a junkyard and calling it a "safe" vehicle.

Now, for my methodological critique: The FalconX report is useful, but it's also limited. It focuses on a specific subset of 23 tokens. What about the *thousands* of other DeFi projects out there? What about the projects that have already gone to zero? Are we only looking at the survivors, and ignoring the graveyard?

It's also worth asking *how* FalconX is gathering its data. Are they relying on self-reported numbers from the projects themselves? Are they tracking on-chain activity? The report doesn't say, and that lack of transparency is concerning.

So, Where's the Real Alpha?

The report concludes that these trends reveal potential opportunities from dislocations in the wake of 10/10. It will be interesting to see if the changes mark the beginning of a broader shift in DeFi valuations or if these will revert over time. The report also suggests that on the lending side, investors may be looking to more fintech integrations to drive growth. AAVE’s upcoming high-yield savings account and MORPHO’s expansion of its Coinbase integration are recent examples of this trend.

Overall, these trends reveal potential opportunities from dislocations in the wake of 10/10. It will be interesting to see if the changes mark the beginning of a broader shift in DeFi valuations or if these will revert over time.

A False Sense of Security?

The data suggests that this flight to "safety" in DeFi is more about relative loss mitigation than actual value accrual. Investors might *think* they're being smart, but they're mostly just rearranging deck chairs on the Titanic.