Okay, folks, buckle up. Because what looks like a crypto winter might just be the perfect time to plant some seeds. We're talking DeFi, and yeah, the headlines aren't exactly screaming "bull market." But that's precisely when the smart money starts to move, isn't it?

The FalconX report paints a pretty stark picture: most DeFi tokens are down – way down – since that October crash. Only a couple are in the green for the year. Ouch. It’s like watching your garden get hit by an early frost. But here’s the thing about gardens: sometimes a good pruning, even a harsh one, makes for stronger growth in the spring.

DeFi's "Shakeout": A Chance for True Innovation to Rise

DeFi's Resilience Amidst the Downturn

What we're seeing now isn't just a crash; it's a shakeout. The "get rich quick" crowd is running for the exits, leaving behind the projects with real potential, the ones building actual, sustainable value. Investors are flocking to safer bets, those with buybacks or unique catalysts. Think of HYPE and CAKE – tokens that, despite the overall downturn, are showing resilience. Then there's MORPHO and SYRUP, outperforming their lending peers thanks to solid fundamentals.

DeFi's Growing Up: From Hype to Hard Numbers

A Shift in DeFi Valuation

This isn't just about picking winners and losers, though. It's about a fundamental shift in how we value DeFi. Some sectors are getting cheaper relative to their activity, while others are becoming more expensive. Spot and perpetual DEXes, for example, are seeing declining price-to-sales multiples. Is this a sign of lower growth expectations? Maybe. But it could also mean we're finally moving away from pure speculation and towards a more mature, metrics-driven market.

And lending? Lending names are holding relatively steady, which suggests investors see them as a more reliable source of yield in a downturn. It’s like everyone’s suddenly realized that in a storm, it's better to have a steady income than a risky trade.

DeFi's Great Purge: Building Back Stronger

Weeding Out the Garbage

I saw a comment on a Reddit thread the other day that really struck me. Someone wrote, "This crash is just weeding out the garbage. The real projects will survive, and they'll be stronger for it." And you know what? I think they're right. This isn't the end of DeFi; it's a necessary evolution. It's a chance for the industry to mature, to focus on real-world use cases, and to build a more sustainable ecosystem.

DeFi's Forest Fire: Resilience Through the Crash

The Importance of Resilience and Humility

The big idea here is resilience. The DeFi space is showing that it can adapt, even thrive, amidst volatility. It’s like a forest fire – destructive in the short term, but ultimately clearing the way for new growth and biodiversity.

Remember what Eric Peters said? "Investors who blow up and lose everything tend to believe that they know exactly why a market should be moving." Humility, he argues, is key to survival. And right now, humility means recognizing that the market knows something we don't. It means being open to the possibility that this crash isn't a disaster, but an opportunity.

DeFi Gambles: Innovation or Just Hot Air?

Innovation and Risk in New DeFi Solutions

Consider Bitcoin Hyper (HYPER), a new Layer 2 solution. Otar, over at Coinspeaker, notes the $28.86M raised shows demand, but raises concerns about the anonymous developers and lack of public code. It's a gamble, no doubt, but it also represents the kind of innovation that could drive the next wave of DeFi growth. Or take Ethena (ENA), a synthetic dollar protocol. Otar calls the delta-neutral model risky, but acknowledges its potential to create a stablecoin independent of traditional banks. These are the kinds of bets that could pay off big in the long run. The 43% staking APY is unsustainable, and with fierce Bitcoin Layer 2 competitors already out there, I believe, this is speculation on promises until they ship actual working infrastructure, which is a risk.

DeFi's Pragmatic Pivot: Fintech Integration to the Rescue?

DeFi's Shift Towards Practicality and Fintech Integration

But here’s where it gets *really* interesting. What if this downturn is forcing DeFi to become more… practical? The FalconX report hints at this, suggesting investors are looking for fintech integrations to drive growth. AAVE’s high-yield savings account and MORPHO’s Coinbase integration are prime examples. Suddenly, we're not just talking about abstract financial instruments; we're talking about real-world applications that can benefit everyday people. According to

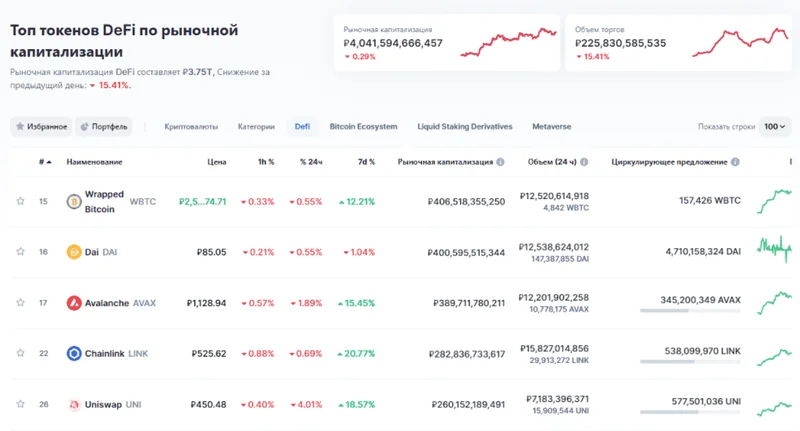

DeFi Token Performance & Investor Trends Post-October Crash, investors are indeed shifting their focus after the crash.

DeFi: Building Bridges to a More Accessible Financial Future

Building Bridges and Offering Tangible Value

What does that mean for us? It means the future of DeFi might not be about disrupting the entire financial system overnight. Instead, it might be about building bridges, integrating with existing infrastructure, and offering tangible value to users. It might be about making finance more accessible, more efficient, and more transparent.

I first heard about Bitcoin, and I honestly thought it was a joke. Now look at us.

DeFi's Promise: A Call for Responsible Innovation

Responsibility and the Future of DeFi

Of course, with every opportunity comes responsibility. As we build this new financial ecosystem, we need to be mindful of the risks, the potential for abuse, and the need for regulation. We need to ensure that DeFi is truly decentralized, that it's accessible to everyone, and that it's used for good.

DeFi's "Crash" Isn't Failure—It's a Spring Cleaning!

Conclusion: A Wake-Up Call and an Opportunity

So, What's the Real Story?

The October crash wasn't the end of DeFi; it was a wake-up call. It was a chance to prune the deadwood, to focus on fundamentals, and to build a more sustainable ecosystem. And for those brave enough to see the opportunity, it might just be the perfect time to buy.